- September 30, 2025

- Posted by: admin

- Category: News

No Comments

Mauritius Economy and Inflation:

- Headline inflation eased slightly to 4.8% year-on-year in August 2025, down from 5.2% in July, helped by a decline in food and non-alcoholic beverage prices.

- Core inflation rose to 7.4% in August, indicating persistent underlying price pressures, driven by wage pressures in labor-intensive sectors and broad inflation across consumption categories.

- The Bank of Mauritius expects headline inflation to average around 4.0% in 2025, with risks tilted to the upside including global uncertainties and domestic wage-driven inflation.

Trade and Reserves:

- The trade deficit widened to MUR 19.1 billion in June 2025, due to a 10.4% drop in merchandise exports and continued growth in imports.

- Key export categories such as crude materials, manufactured goods, and chemicals saw significant declines.

- Despite a slight dip, international reserves remained strong at about MUR 431 billion, covering around 12.9 months of imports, ensuring a stable cushion against external shocks.

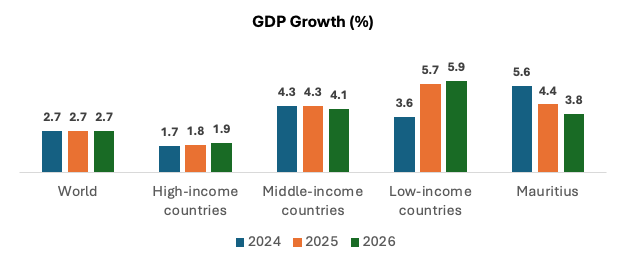

Economic Growth Outlook:

- GDP growth slowed to 4.2% year-on-year in Q1 2025 from 5.2% in Q4 2024, with projections indicating a slowdown to 3.5% average growth for 2025.

- The slowdown is due to weaker tourism and construction sectors, drought impacts on agriculture, and subdued external demand.

- Private consumption remains the main growth driver, though it may weaken in the second half of 2025 due to inflation and agricultural challenges.

- The government is focusing on investment in infrastructure and digital transformation to support growth.

Additional Highlights:

- Mauritius remains Africa’s most economically free country as of 2025.

- The country has become Africa’s most competitive financial hub, surpassing Casablanca.

- The Bank of Mauritius has kept the key policy rate steady at 4.5% to balance inflation and growth.

These points provide a comprehensive picture of Mauritius’s current economic situation in 2025, highlighting inflation trends, trade dynamics, growth projections, and strategic positioning in the region’s financial landscape.